Confiscated properties in Cyprus in 2024

The 2013 financial crisis in Cyprus had a profound effect on the island’s economy, with one of the most significant consequences being the surge in bank-confiscated properties.

This was largely driven by the rise in non-performing loans (NPLs), which forced banks to repossess collateral properties. In this article, we explore the causes of property confiscation, the legal and economic frameworks introduced to manage the issue, and the statistical landscape of repossessed properties and NPLs in Cyprus.

The 2013 Financial Crisis: A Data Overview

In March 2013, the Cypriot banking sector collapsed under the weight of bad loans and overexposure to Greek debt. The €10 billion bailout package from the European Union (EU), International Monetary Fund (IMF), and European Central Bank (ECB) included a “bail-in” measure, where depositors with accounts over €100,000 in the island’s two largest banks, Bank of Cyprus and Laiki Bank, lost significant portions of their savings.

This bailout was a lifeline for the banks but came at a significant cost to the local economy, businesses, and homeowners. It was the first time since the Great Depression that bank accounts were confiscated (Executive Order 6102).

Non-Performing Loans (NPLs): The Magnitude of the Crisis

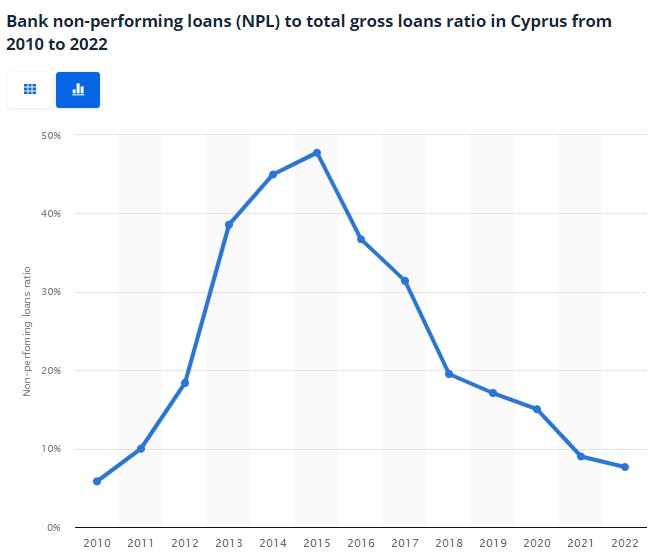

The rise of NPLs was one of the most critical issues in the aftermath of the financial crisis.

By 2014, Cyprus had one of the highest NPL ratios in the Eurozone, with NPLs accounting for nearly 50% of total loans in the banking sector.

Key Statistics:

- Total loans in Cyprus stood at around €62 billion in 2013.

- Non-performing loans skyrocketed to approximately €27 billion, making up 45% of the total loan book in 2014

- In the household sector, NPLs accounted for 43.1% of all loans by the end of 2015.

- NPLs in the corporate sector were even higher, reaching 57% of total corporate loans by 2015.

Many of these loans were tied to the real estate and construction sectors, which had boomed in the years preceding the crisis. When the economy contracted by 6.6% in 2013, property values plummeted, leaving borrowers unable to repay their loans and banks scrambling to recover their losses.

Legal Framework for Foreclosures and Repossessions

To tackle the growing NPL problem, the Cypriot government implemented several reforms, significantly altering the legal landscape surrounding property confiscation and foreclosures.

(1) Foreclosures Law (2014)

The introduction of the Foreclosures Law in 2014 marked a turning point, providing banks with the ability to repossess and sell properties used as collateral for bad loans more swiftly. This led to a surge in foreclosure auctions as banks sought to clean up their balance sheets. From 2015 to 2018, over 2,500 properties were sold through foreclosure auctions.

(2) Insolvency Framework (2015)

To balance the impact of the foreclosure law, the government introduced the Insolvency Framework in 2015. This framework allowed distressed borrowers to restructure their debt, offering certain protections for primary residences. However, statistics show that despite these measures, a significant portion of foreclosures—around 25%—involved primary residences, highlighting the ongoing vulnerability of homeowners.

(3) Asset Management Companies

Banks transferred significant portions of their NPL portfolios to Asset Management Companies (AMCs) to accelerate the repossession and sale of properties. KEDIPES (Cyprus Asset Management Company), which took over the assets of Laiki Bank, managed around €8.2 billion worth of NPLs and repossessed properties as of 2023. By mid-2023, KEDIPES had sold assets totaling over €1.5 billion.

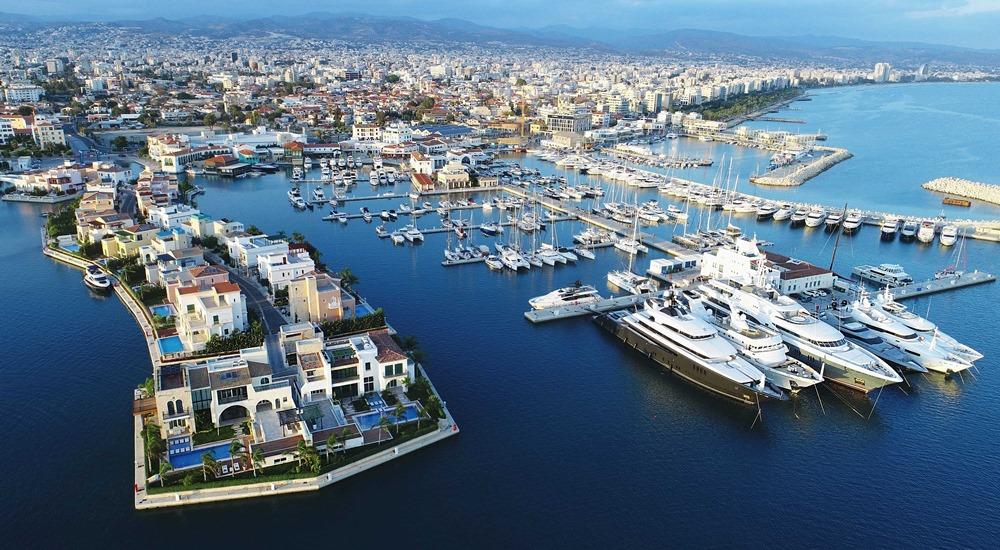

Impact on the Real Estate Market

The flood of confiscated properties onto the market had a profound impact on the Cypriot real estate sector. Property prices dropped significantly in the years immediately following the crisis, particularly in areas with high concentrations of repossessed properties.

Price Decline Statistics:

- Between 2013 and 2016, property prices fell by 30% to 40% in many areas, especially in Nicosia and Limassol.

- Residential real estate prices fell by 30.6% in Nicosia between 2010 and 2016, with prices only starting to recover by 2018.

Foreclosure auctions, which were rare in the pre-crisis period, became a regular occurrence, with banks listing thousands of properties ranging from small apartments to large commercial complexes. Between 2016 and 2019, the number of properties put up for auction rose by 70% annually.

NPL Reduction Efforts and the Current Situation

Cyprus has made significant progress in reducing its NPL burden since the peak of the crisis, but challenges remain. Between 2014 and 2023, the total amount of NPLs fell by over €19 billion, driven by the following measures:

(1) Debt Restructuring:

Banks increasingly offered restructuring packages to distressed borrowers, which allowed for loan repayments to be renegotiated. By the end of 2019, restructured loans accounted for 30% of the total NPLs.

(2) Sales of NPL Portfolios:

Banks offloaded significant portfolios of bad loans to foreign investment firms. In 2021, Hellenic Bank sold a €2.3 billion NPL portfolio to a private equity firm, while Bank of Cyprus sold a €2.8 billion portfolio to Apollo Global Management in 2018.

(3) Foreclosure Auctions:

As of mid-2023, banks and AMCs had auctioned off over 5,000 properties, recovering around €2 billion in the process.

Despite these efforts, the NPL ratio in Cyprus remains one of the highest in the European Union. By mid-2023, the total NPLs in the Cypriot banking sector had fallen to around 9% of total loans, a significant improvement but still above the EU average of 3.5%.

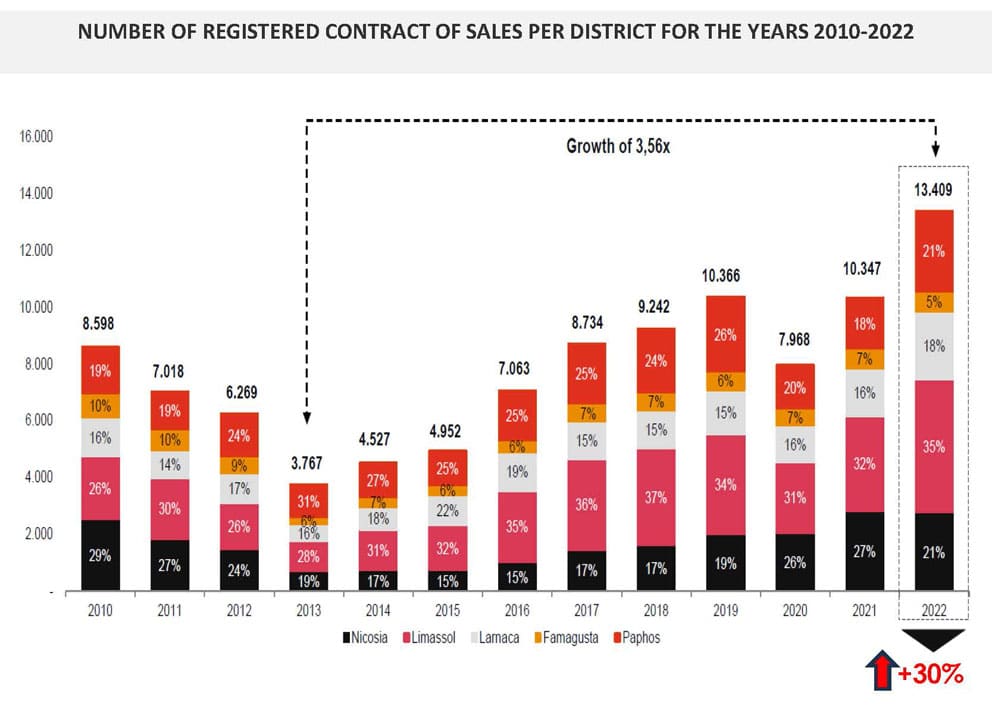

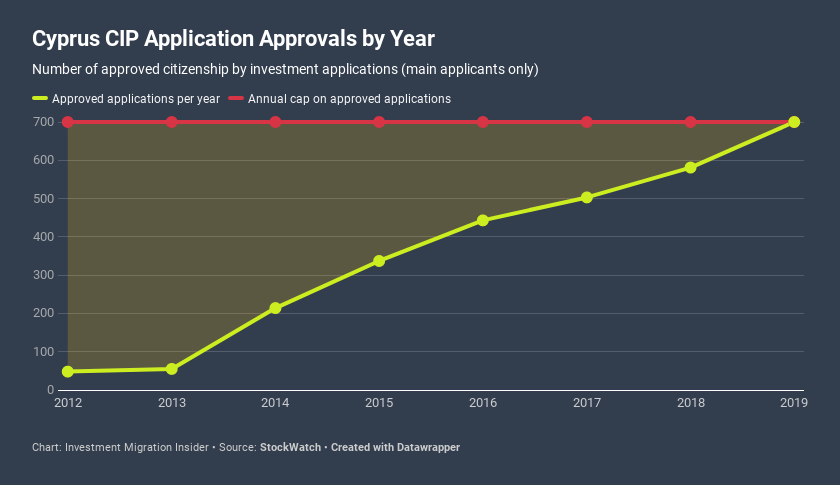

Foreign Investment and the Golden Visa Program

A key factor in the recovery of the real estate market has been the introduction of investment-based residency and citizenship schemes, commonly known as the “Golden Visa” program. Foreign investors, particularly from Russia, China, and the Middle East, were attracted to the opportunity to gain Cypriot residency or citizenship by purchasing real estate.

Key Numbers:

- By 2020, the program had generated over €7 billion in foreign direct investment, the majority of which was funneled into the real estate sector.

- Foreign buyers accounted for nearly 30% of real estate transactions** in 2018, helping to stabilize the market and absorb excess inventory of confiscated properties.

Conclusion

The 2013 financial crisis triggered a wave of property confiscations in Cyprus, as banks faced an unprecedented rise in non-performing loans. Through legal reforms, debt restructuring, and the sale of NPL portfolios, Cyprus has made significant progress in reducing its NPL burden.

However, the scars of the crisis remain visible in the real estate market, where bank-confiscated properties still play a large role.

Despite the challenges, foreign investment, particularly through the Golden Visa program, has helped absorb some of the excess supply of repossessed properties, contributing to a gradual recovery of the property market.

As of 2023, while the NPL ratio remains higher than the EU average, Cyprus has turned a corner and is on a more sustainable path toward economic and financial stability.

How Amazon Consulting Can Help Investors Acquire Confiscated Properties

For investors interested in acquiring bank-confiscated properties in Cyprus, AGS offers a comprehensive range of services designed to streamline the process and ensure that clients secure the best possible deals. Thanks to an extended cooperation with local banks, AGS is well-positioned to assist investors at every stage of the transaction, from identifying promising properties to conducting thorough due diligence.

Valuation Services

AGS works closely with banks to conduct professional valuations of confiscated properties. This service is crucial for investors to understand the real market value of a property, as many repossessed assets may be listed at inflated prices. AGS ensures that all valuations are transparent and reflect current market conditions, helping investors make informed decisions.

Price Negotiation

One of the significant advantages of working with AGS is the ability to negotiate a better price with the banks. Given the company's strong relationships with financial institutions, AGS has a proven track record of securing favorable terms for investors, often below the listed auction price. These negotiations are key in maximizing the return on investment for clients.

Due Diligence

Before proceeding with a purchase, AGS conducts extensive due diligence to ensure the legal and financial standing of the property is sound. This includes verifying ownership, ensuring the property is free of any legal encumbrances, and reviewing the property’s compliance with zoning and regulatory requirements. This level of scrutiny minimizes risks for investors and ensures a smooth transaction process.

Property Condition Inspections

AGS's team of experienced engineers is dedicated to providing a thorough examination of the physical condition of the property. Many confiscated properties, having been unoccupied or neglected for extended periods, may suffer from structural issues or require repairs. The engineers assess the extent of any damages, providing a detailed report on required renovations and potential costs. This helps investors avoid unexpected expenses and make informed decisions about their investments.

In summary, AGS Amazon Group Services offers a comprehensive, hands-on approach to acquiring confiscated properties. From valuations and price negotiations to due diligence and property inspections, AGS ensures that investors navigate the complexities of the Cypriot property market with confidence and success.